The Community Preservation Committee (CPA) recently held two public meetings to present ideas to the public on how the city should handle Community Preservation Act funding. — Photo by Douglas Yu

By Douglas Yu

With the city undergoing development all over, and with the MBTA’s ambitious Green Line Extension project set to make 85 percent of the city within a half-mile of a transit center, residents’ attention is turning to preservation.

The Community Preservation Committee (CPC) held two public meetings this month to address how the city should prioritize spending Community Preservation Act (CPA) funding. More than 60 residents attended the meetings to share their opinions about what parts of the city and what issues, including affordable housing, historic preservation, open space and outdoor recreation, CPA funds could be used to improve and address.

CPA Manager Emily Monea opened the discussion by looking at previous successful CPA-funded projects.

“This Douglas House, it’s a studio-type, barrier-free rental apartment units for brain-injured adults,” Monea said of an example about how CPA funded the construction of a public-service facility.

View other CPA-funded projects: http://www.communitypreservation.org/

“CPA can also preserve documents,” Monea said.

In 2011, CPA funds were used for a project to scan and preserve historic documents, including the framing and displaying of documents, as well as the purchase of equipment to make the historical information accessible to the public, according to the CPA’s website.

In 2009, Needham used $15,029,233 in CPA funding to restore its town hall, which was also considered one of the “galvanizing forces” for the town to adopt CPA in 2004, according to the CPA’s website.

“The city used CPA to restore the town hall and then used additional funding,” Monea said of the most expensive project in the CPA’s history, “so keep in mind that you can combine CPA funding and other funding sources.”

One of the Somerville residents at the meeting, Mary Magan, raised the question about how the CPC coordinates with city departments to sustain a city project, since CPA funds cannot be used to cover maintenance costs.

CPC members clarified that the meeting was not about choosing specific projects. Rather, it was being held in order to have a public conversation about what the priorities should be when evaluating projects.

Elizabeth Duclos-Orsello, one of the CPC members representing the general public, also mentioned key components in projects applications, one of which is likely to be “requesting some narrative or information about thinking forward about the sustainability of the project, since you can’t use the money for maintenance.”

During the final testimony, former alderman Courtney O’Keefe brought up some open space projects that the CPC might consider.

“One of them is Sullivan Park,” O’Keefe said. “It’s pretty dark and not even close to well-lit enough at night. It really prevents a lot of people from feeling safe when they walk pass the park.”

O’Keefe would also like to see CPA’s coordination with the Capital Investment Plan (CIP).

“The matching is really wonderful,” she said. “The projects listed here [in CIP] actually have dollar amounts associated with them.”

Besides the testimonies on Sullivan Park and the CIP, O’Keefe suggested that Somerville Junction Park, which is located along the planned extension of the Community Path, develop into a community garden.

The association of CPC members or aldermen with the applicant is something that O’Keefe would watch very closely.

“Anybody who works for them, who used to work for them, served on the board and brought political contributions; I’m going to speak out loud,” O’Keefe said, “because I want an even-level playing field and not for one organization to get priority over another.”

Currently, according to the city, the CPC is in the process of creating an application for parties interested in receiving funding for eligible projects and a community preservation plan. Both documents should be released this summer.

View the full CPC presentation

http://www.somervillema.gov/sites/default/files/CPA%20public%20hearing%20presentation_05.12.14.pdf

The CPA in Somerville

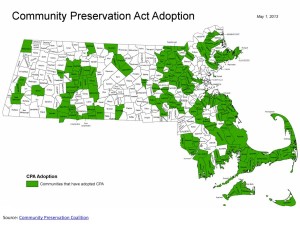

In November 2012, 76 percent of Somerville residents voted to pass the CPA, making Somerville the 155th municipality in the state to receive steady funding aimed at improving and preserving the characteristics and quality of life in the community.

With passage of the CPA, the city created a Community Preservation Fund (CPF) to be devoted solely to affordable housing, historic preservation, open space and outdoor recreation projects.

There are three key sources of the funding for the CPF, according to CPA Manager Emily Monea.

“The first is surcharge revenue,” she said. “This is the primary thing that CPA adopted in November 2012: a 1.5 percent surcharge on net property taxes with a few exemptions.”

The first $100,000 of assessed value is exempt, and qualifying low- and moderate-income households may also apply for the exemption.

The second source is municipal revenue.

“What Somerville adopted is called ‘blended CPA,’ so the city is able to incorporate an additional $1.2 million into the CPA fund,” she said. “It’s important because it helps the state match the third funding source.”

The state’s Community Preservation Trust Fund distributes money to municipalities on an annual basis. Its distribution includes surcharge and municipal revenue.

“The state matches all local funding from CPA at an overall rate over the years of between about 25 to 50 percent,” Monea said. “Right now, the rate is estimated to be about 24 percent, and we hope that will go up, because the state is considering a transfer of $25 million into the state trust fund.”

To help evaluate the prospective funding projects and prepare a budget for the Board of Aldermen, nine members, who represent each use of the future CPA funding, were elected as part of the Community Preservation Committee (CPC).

Reader Comments