(The opinions and views expressed in the commentaries and letters to the Editor of The Somerville Times belong solely to the authors and do not reflect the views or opinions of The Somerville Times, its staff or publishers)

By State Senator Pat Jehlen

As you know, there are five ballot questions on our November ballots. Last week, I wrote about why I am voting yes on Question 2.

There are also local ballot questions about increasing local revenue in Somerville, Medford, and Winchester. I will vote yes in Somerville, and would vote yes in Medford and Winchester.

I’ll share information from local leaders about each local question, but first some state-wide perspective.

WHY DO OUR COMMUNITIES NEED MORE REVENUE?

Massachusetts communities have fewer powers than in most other states. They can’t adopt any taxes or fees without permission of the state. Currently property taxes are their main source of revenue, and are limited by Proposition 2 1/2. The state has given them power to adopt limited taxes on hotels, meals, and recreational marijuana. They also collect vehicle excise taxes. They can also adopt a Community Preservation Act surcharge of up to 3% on property taxes.

Cities and towns also have limits on their ability to set speed limits, create zoning ordinances, issue liquor licenses, and many other powers that are available in other states.

PROPERTY TAXES CAN’T KEEP UP WITH INFLATION

Property taxes are the main source of revenue for cities and towns, accounting for 59% of local budgets across the state. Mass. Taxpayers Foundation has a report showing the sources of revenue for each community. All communities in our district get well over half their local budgets from the property tax.

Proposition 2 1/2, adopted by ballot question in 1980, continues to limit property tax increases.

The property tax levy is the revenue a community can raise through real and personal property taxes.

The property tax levy limit is the total dollars collected the previous year plus 2 1/2%. Property tax revenues cannot be increased more than 2 1/2% over the prior year’s revenues, except for new growth and overrides. Communities can increase the levy limit each year to reflect new growth in their tax base, due to new construction or renovations. They can also pass overrides and debt exclusions through ballot questions.

The property tax levy ceiling (the total that can be raised) can never exceed 2 1/2% of the full cash value of all taxable property in the town. In other words, tax rate cannot be higher than $25.00 per $1,000 valuation. The property tax levy ceiling (the total that can be raised) can never exceed 2 1/2% of the full cash value of all taxable property in the town. A tax rate cannot be higher than $25.00 per $1,000 valuation.

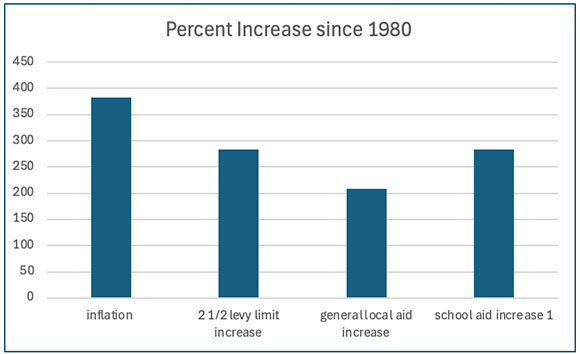

Inflation since 1980 is 382%.

But 2 1/2% increases compounded since 1980 are 284%.The limit of a 2 ½ percent increase per year is a problem when inflation is over 2 ½ percent – which is often. When that happens, the buying power of the municipality goes down. That means services deteriorate. Potholes can’t be fixed, libraries may have to cut back their hours, class sizes in the public schools may increase.

LOCAL AID FOR SCHOOLS HAS INCREASED BUT NOT AS MUCH AS INFLATION

Property taxes are the primary source of municipal revenue, accounting for almost 60% percent of all municipal revenues in FY 2022. “This share has grown consistently over time,” Mass. Taxpayers reports, meaning the state is picking up less and less of local costs, while local revenues are limited.

Prop 2 1/2 dramatically lowered local revenue by cutting the tax rate to 2 1/2% in many communities to start with, and then limited its increases.

Property values were very different in different communities, and Somerville at the time had a low tax base. Reliance on property taxes meant that Somerville property taxes were twice as high as neighboring communities, while school spending per pupil was half as much. It also meant that Prop 2 1/2 hit us harder than communities with higher tax bases. Our low spending was reduced even more.

I was on the Somerville School Committee. We closed 6 elementary schools and 3 junior high schools in 1980 and soon after.

I joined many local officials in lobbying for increased local aid to make up some of the difference. I also co-founded the Council for Fair School Finance. We sued the state and the Supreme Judicial Court agreed with us that the state government was violating the state constitution by failing to adequately fund schools. That led to the passage of the Mass. Education Reform Act of 1993 (MERA). MERA included a massive increase in Chapter 70 aid to public schools over many years. Aid then leveled off until passage of the Student Opportunity Act of 2015, and has not increased enough to keep up with inflation over the long haul.

GENERAL LOCAL AID HASN’T KEPT UP WITH INFLATION EITHER

While local aid is always at the top of legislators’ budget priorities, general local aid – apart from school aid – has (At that link, you can look up detailed aid by year for your community or for the state totals.)

Mass. Taxpayers reports that property taxes as a share of local revenue have “grown consistently.” But due to Prop 2 1/2 limits, that growth is not enough to keep up with inflation.

Most communities across the state have tried to meet their needs through either overrides or the Community Preservation Act – or both.

MOST COMMUNITIES HAVE PASSED AT LEAST ONE OVERRIDE

Overrides are for continuing needs and permanently increase the levy limit (but not the levy ceiling). They allow an increase for specific purposes with a dollar limit.

Debt Exclusions allow debt service payments for a specific project above the levy limit. They are temporary, and expire when the bonds are paid off.

More information on overrides and exclusions is here.

Map from Maptitude. Towns that have had 25 or more override votes are labeled, with the majority on Cape Cod and Boston’s western (wealthier) suburbs.

MOST COMMUNITIES HAVE ADOPTED THE COMMUNITY PRESERVATION ACT

The Community Preservation Act allows cities and towns to create a fund to support improvements in Open Space & Outdoor Recreation, Affordable Housing, and Historic Preservation. The CPA enables communities to raise money through a surcharge of up to 3% on property taxes, which is partially matched every year by the state. That match is one reason so many communities have adopted CPA.

Map from Community Preservation Coalition, which has lots of information on the CPA.

MEDFORD OVERRIDES: QUESTIONS 6, 7, AND 8

Medford voters can vote on two overrides:

#7 to avoid reductions in school services and create a sidewalk and roadway repair crew.#8 to improve school offerings and increase salaries for staff including paraprofessionals.

They can also vote on #6 a temporary debt exclusion to allow construction of a new fire headquarters.

The city’s website has good information on the three questions, More information is on the Invest in Medford website, especially the FAQ section. Invest in Medford includes a list of supporters.

Medford adopted a 1.5% CPA in 2015. This past year, it spent $2.5 million in CPA funds, 34% for housing, 37% for historic preservation, and 29% for open space and recreation.

SOMERVILLE QUESTION 6: INCREASE COMMUNITY PRESERVATION ACT SURCHARGE FROM 1.5% TO 3%

Somerville adopted the CPA in 2012 at a surcharge rate of 1.5%. It exempts the first $100,000 of residential and commercial property value from the surcharge. There is also an exemption for low-income households.

Somerville’s question 6 would increase the CPA surcharge to 3%. This information is from the city’s website and the campaign website:

- The CPA program currently generates about $3 million per year.

- Since 2014, the CPA program has given $18.2 million to affordable housing, $9.7 million to historic preservation projects, and $7.6 million to open space and recreation.

- The City has borrowed against CPA revenue for projects that created over 100 units of affordable housing, and to construct an elevator in the West Branch Library.

- $24 million in local revenue has generated $7 million in state match, and leveraged $315 million in funding from other sources.

- More information and a list of projects funded by CPA can be found in the FY25 Annual Report.

An increase to the maximum allowable 3% would generate twice the revenue and give the city twice as big a share of state funding. Somerville has prioritized housing affordability, which is the biggest issue in our district.

The photo is from the kickoff Sunday at Prospect Hill Tower, whose renovation and repair was done with CPA money.

Somerville has done one debt exclusion in 2017, to build the new high school.

WINCHESTER: QUESTION 6: ADOPT COMMUNITY PRESERVATION ACT

Winchester voters can vote for Question 6, to adopt a Community Preservation Act surcharge of 1.5%. Detailed information, including potential projects that could be funded, is in the CPA Study Committee’s report to Town Meeting. A short summary, including supporting groups is here. And Winchester News has a good report here.

The CPA Study Committee report says that “Assuming the CPA Study Committee’s recommendations are adopted, and with current property tax rates, Winchester can expect to generate ~$8.4m in surcharge revenues over the next 5 years, with a possible state match at 20% of $1.3m.”

Winchester has done 12 debt exclusions, 7 of them for schools, and was successful in all but one.

CAMBRIDGE: 3% CPA ALREADY ADOPTED, NO BALLOT QUESTIONS

Cambridge has done no overrides or debt exclusions. It adopted a 3% CPA in 2001.

Reader Comments