(The opinions and views expressed in the commentaries and letters to the Editor of The Somerville Times belong solely to the authors and do not reflect the views or opinions of The Somerville Times, its staff or publishers)

By Chris Dwan

Budget season in Somerville is starting off with a cool tone that approaches austerity. The School Committee has been told to expect a budget that will fail to cover mandatory increases like seniority-based pay raises. The City Council heard last Thursday that any new initiatives will need to fit in less than $15M.

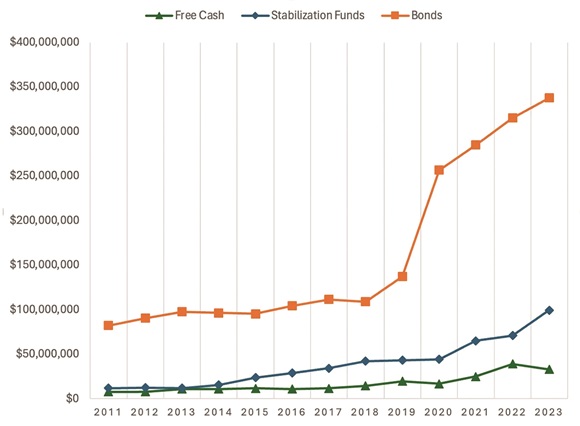

This is a bit jarring, given that we are sitting on unprecedented amounts of cash. Our various stabilization funds, the accounts we use to carry money forward from year to year, hold more than $100M – a sixfold increase over the $15M we had in the bank just 10 years ago. We also seem likely to end the year with record levels of free cash, money received in excess of expenses within a fiscal year. Last year’s free cash was $32M, down from the $38M we had at the end of 2022, but more than threefold the $10M we averaged in 2011–2017.

The city has been awash in cash for the last decade, both in absolute terms and also year over year, but we seem stuck with deferred maintenance and general belt-tightening while money piles up unused. I took a dive into the last ten years of Comprehensive Financial Reports (on the Finance Department’s website) to try to understand why.

One thing that’s going on is that we’ve incurred a huge amount of debt over the last decade. Somerville’s municipal bond obligations rose from $96M to $337M from 2014 to 2023. A bit over half of that increase was attributable to the high school. We need a correspondingly huge amount of cash on hand to maintain the “debt ratio,” that drives our credit rating. Mayors Curtatone and Ballantyne have squirreled money into stabilization funds just as fast as they possibly could in a (successful) effort to maintain the city’s ability to borrow money on the very best terms.

Somerville’s debt has grown by a quarter of a billion dollars in the last ten years.

This is in no way bad or nefarious. In fact, it was probably the best move available to either administration. It is, however, frustrating to see desperately needed infrastructure work, pay increases for staff, and hiring pushed back years at a time when we have a hundred million dollars in the bank.

Proposition 2.5 is another constraint on the city’s finances. This is a statewide rule that caps the amount that cities in Massachusetts can increase their total property tax levy to 2.5% per year, excluding new construction. With real property values in Somerville growing far faster than that year over year, Proposition 2.5 has created a huge and growing gap between real and assessed property values.

Owners who think of property primarily in terms of investment, rather than as a place to live or to run a business, can leverage the gap between taxable and market price to accumulate value tax-free. This “land banking” is one of the reasons that we have so many vacant properties throughout the city despite a run-up in demand that seems like it should have encouraged owners to sell and investors to develop.

I am not aware of any simple solution to these challenges, at least in the short term. We have a lot of debt, so we need to either hoard cash to protect our credit rating or empty the coffers to pay it down ahead of schedule. Proposition 2.5 constrains our operating budget, and land banking discourages the new construction that would let us get around it. We will likely need to incur still more debt in coming years to repair our crumbling schools, roads, and other infrastructure, all while cutting operating funds and pushing back on pay increases for staff to support the debt ratio. Creative ideas like best-use taxation, fines and fees on vacant properties, and so on always look great on paper but seem to get bogged down in implementation.

Understanding the root causes of a problem is usually an important first step in solving it. That’s why I thought it would be good to take a moment to, as we say on social media, admire the ratio.

Reader Comments