(The opinions and views expressed in the commentaries and letters to the Editor of The Somerville Times belong solely to the authors and do not reflect the views or opinions of The Somerville Times, its staff or publishers)

By State Senator Pat Jehlen

The main argument given for reducing taxes is that we need to be competitive with other states. Some tax credits, like most of those the House and Senate initially approved last year, benefit people across income brackets.

This year, Gov. Healey and the House added proposals for hundreds of millions of dollars in tax breaks for people with high income and profitable corporations. Without these tax cuts, it’s argued, those people and businesses will leave, or avoid moving to, the state. They are said to be especially likely to leave because of the Fair Share Amendment, adopted by the voters last fall after a long campaign.

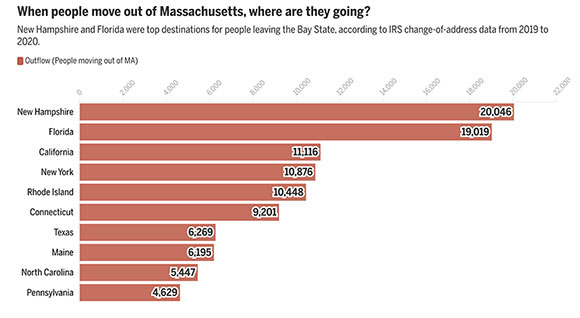

Some people say that 110,000 people have left the state since the beginning of COVID, and that the largest number have gone to New Hampshire and Florida, which don’t have an income tax. For example, House Speaker Ron Mariano “expressed concern about the out-migration in Massachusetts, with more than 110,000 leaving for other states since early 2020.”

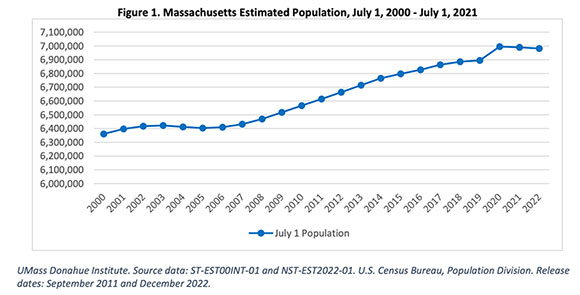

The 110,000 number is somewhat misleading, since people also moved into Massachusetts. The net loss in those two years, according to the Donahue Institute, is 47,975. Of that, all but 7,716 was in the first pandemic year.

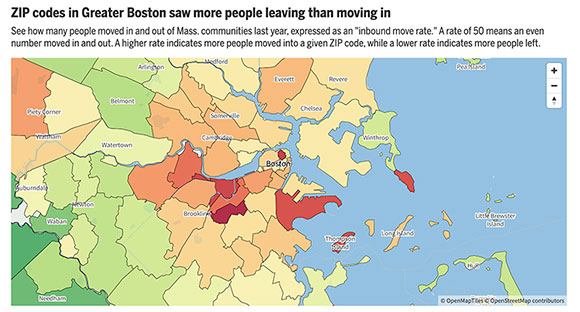

(Graph from Boston Globe – from 2019-2020 – before the Fair Share Amendment was on the ballot)

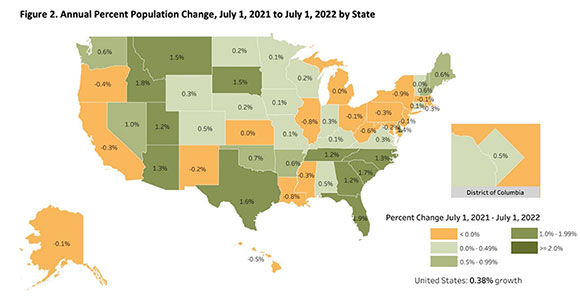

In January, the Donahue Institute at UMass Amherst reported, except for the pandemic years, Massachusetts has been gaining population. Interestingly, another state with the same recent decline in population is Alaska, which has neither an income tax nor a state sales tax. Who’s leaving and why?However, it doesn’t look like the problem is wealthy people leaving; it’s workers.

Senator Jason Lewis of Winchester said it succinctly in a letter to the Globe:

The problem with the gossiping and hand-wringing from some business leaders; accountants for the superrich; and the Globe about wealthy Bay Staters “fleeing” Massachusetts for tax havens is that they are entirely focused on the wrong challenge facing our state.

The real challenge is the young people who graduate from our excellent public and private colleges but cannot afford to stay in Massachusetts given their crushing student debt burden, high housing costs, and broken public transportation system.

The real challenge is the low- and middle-income working families who want to continue raising their children here but are struggling due to sky-high child-care costs and other unaffordable living expenses.

The real challenge is the seniors who have lived and worked in Massachusetts for decades and want to retire here but wonder if they will be able to do so with basic financial security and dignity.

Pursuing solutions to these real challenges is what Governor Maura Healey and state lawmakers need to focus on.

State Senator Jason Lewis

Craig Slatin of Medford also wrote a letter to the Globe:

The Globe story about millionaires possibly leaving the state due to the fair share tax said that some of the extremely wealthy are angry that their contributions to the state are not being “rewarded and respected for what they’ve done.”

Consider, who does more for the overall well-being of our Commonwealth than our sanitation workers? Without their literally back-breaking work, we would be living in filth and stench, at risk of many infectious diseases and surrounded by swarms of insects, rodents, and other animals endangering children and adults. Sanitation workers are our foundation of public health and, in that manner, democracy. Yet their rewards are not anything near the requirement to pay the extra 4 percent income tax.

Others whose work is invaluable for sustaining the good life in Massachusetts are child-care workers, educational support professionals, teachers, nurses, librarians, supermarket employees, postal workers, and countless others whose rewards don’t trigger paying the 4 percent surtax. And then there are the many mothers who raise children for no compensation.

No one amasses great wealth without the deep contributions of many workers and public infrastructure and services. So, to those wealthy individuals considering moving to a tax haven, please reflect on what the rest of us have provided for you and pay your fair share.

Craig Slatin

Some people seem to think “tax cuts” is a single thing. But it matters what the particular tax cut and its purpose are. Cutting the short term capital gains tax or expanding the single sales factor will not benefit the average worker.

A recent forum hosted by the Boston Business Journal asked eight business leaders about the biggest challenges facing their industries. Only one mentioned taxes.

The Mass. Business Roundtable report, A Talent Agenda to Drive Massachusetts’ Competitiveness, recommended 11 policies. One was unspecified tax changes. Others were major but unquantified investments in housing, transportation, broadband, caregivers, education, etc. It’s hard to both decrease revenue and increase spending.

Are there any studies about wealthy people fleeing taxes?

Indeed there are!

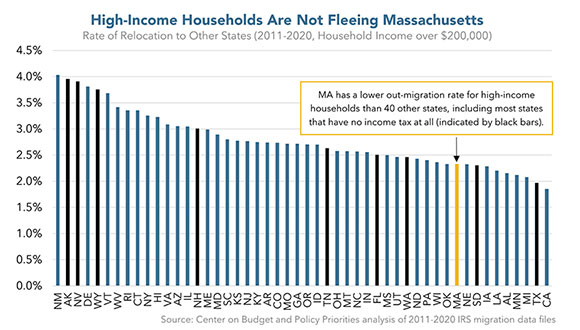

Mass Budget reported on a study of migration of households with over $200,000 income from 2011-2020:

The American Sociological Review studied IRS data for all million-dollar income-earners in the US over 13 years. “Millionaire Migration and Taxation of the Elite” found that “millionaire tax flight is occurring, but only at the margins of statistical and socioeconomic significance.” “Outside of Florida, differences in tax rates between states have no effect on elite migration. Other low-tax states, such as Texas, Tennessee, and New Hampshire, do not draw away millionaires from high-tax states.”The same authors studied millionaire migration in California. In 2005, California introduced the Mental Health Services Tax. This tax is 1% on amounts of taxable income greater than $1 million. They found that “the highest-income Californians were less likely to leave the state after the millionaire tax was passed.”

The Globe interviewed people on why “People are leaving.” They were all driven out by housing costs, not taxes. One woman, for example, moved to New York City to get “her own place, rent control, easy public transit access.”

And here’s a memo by my chief of staff, Matt Hartman. Among his fascinating conclusions from census data is that intra-state migration is increasing segregation through white (and wealth) flight from the city center to wealthy suburbs. (view this Globe map with links)

Nevertheless, the number of millionaires in Boston has grown by 50% in the past decade.What’s the real population problem?

Another Boston Globe article this week reports on young workers fleeing the state because of high prices, especially for housing.

Most industries are facing labor shortages. John Regan, head of Associated Industries of Massachusetts, in his February annual address, said that,”the state currently has 115,000 more job openings than unemployed workers…By 2030, the number of jobs across Massachusetts is expected to grow 21%…but the workforce will expand just 1.5%.” For direct care workers, who make very low wages, the shortages are dire, as I reported in December.

How much is enough? Over the last few years the state has added new revenue streams from gambling, marijuana, and increased tax rates. At the same time Massachusetts government spending continues to increase at rates higher than the average taxpayer’s income increases. The proposed FY2024 $56 billion budget is 7.1% higher than the previous year’s budget.

It appears that the state has a spending problem and not a revenue problem. Rather than trying to develop solutions to make the state operate more efficiently, you opt for the same simple methods of just increasing the tax burden on the citizens. Since most Massachusetts residents already feel that they are overtaxed and now rebel with referendums to overturn excessive taxation at the ballot box, you are embarking on taking the low road of using class warfare to feed the undisciplined government even more money.

I’m not a multi-millionaire, nor do I have a $1 million plus annual income. I’m knowledgeable enough though to realize that you can lose the goose that lays the golden eggs. Even before enactment of the millionaires’ tax this year, the wealthy were leaving Massachusetts. Massachusetts’ net loss of adjusted gross income to other states grew from $2.5 billion in 2020 to $4.3 billion in 2021, according to Internal Revenue Service data, with a net loss of 12,700 residents moving to New Hampshire and Florida alone. Overall, 60% of those who moved out of state from 2020 to 2021 had incomes above $200,000. These are net totals from the IRS and not cherry-picked totals from a selected study to support a point of view. With remote work becoming the norm for large groups of workers

Massachusetts income taxes for couples filing jointly is already the highest in the nation, with couples paying 23.51% of their income in taxes. For higher incomes, according to IRS data, the top one percent paid 42.3% of the total federal income tax in 2020 while receiving 22.2% of total adjusted gross income. Again I ask, “How much is enough?”

So far in 2024 we have seen April tax revenues drop more than $2.1 billion below collections for last April and more than $1.4 billion below predictions for the month. I suspect that a significant amount of that was due to a drop in quarterly tax payments from people who have either left the state or are planning to leave the state this year. Projecting that quarterly total drop out for a year could mean an overall annual loss of up to $8.4 billion.

Despite the reality of the numbers you see not only in Massachusetts, but also in other high tax rate states such as New York, Connecticut, and New York, you elect to pursue further increasing tax rates. Despite Massachusetts being one of just 12 states with an estate tax and having the lowest estate tax exemption threshold in the country, you are sponsoring a bill to increase the estate tax to nearly 20% for all estates over $2 million. If you don’t believe this will accelerate the rate of the wealthy leaving Massachusetts then I have a bridge to sell you.