(The opinions and views expressed in the commentaries and letters to the Editor of The Somerville Times belong solely to the authors and do not reflect the views or opinions of The Somerville Times, its staff or publishers)

By State Senator Pat Jehlen

The next two and a half weeks in the legislature are going to be packed!

Monday I wrote about important pieces of the Senate’s version of the Housing Bond Bill. This is about why the bond bill is not enough. Following will be newsletters about the immediate emergency, and possible solutions to keep people in their homes.

WE NEED MUCH MORE SOONER!

Housing is the biggest problem for most individuals, most families, most communities, most businesses in our state. The crisis demands both funding and more tools.

The McKinsey study projected that we need 125-200 thousand new units by 2030. The administration says their bill could enable construction/preservation of up to 45,000 units over 5 years.

And that assumes that all the bonding is issued for this purpose.

The bill authorizes $5.1 billion in long-term capital spending on housing, but the state is currently limited to about $400 million a year in capital spending on housing under its latest five-year capital budget. The bond authorization doesn’t mean the state will sell all the bonds. It only designates priorities and creates a menu of ways to spend bond money that the governor’s office can choose from.

(The bill is certainly a bigger commitment than Treasury Secretary Janet Yellen made. She announced the Fed would provide $100 million to support affordable housing across the country over the next 3 years. But can’t offset the cost of the Federal Reserve’s high interest rate.)

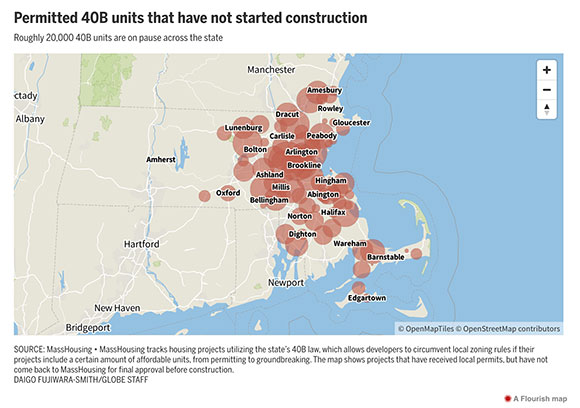

We need private investment to build most of the new housing, but costs are so high that it’s hard. The Globe just reported that, due to high interest rates and construction costs, even permitted mixed income housing developments are stalled.

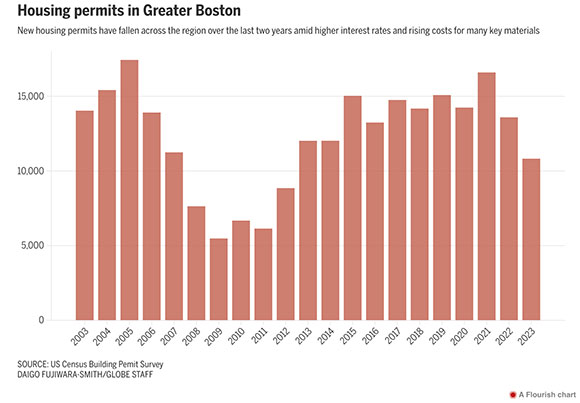

Through the first five months of the year, building permits for fewer than 5,000 units were issued across Greater Boston. “That’s down a bit from the same time in 2023, which itself was the slowest year for new housing production in more than a decade.”

Note: An alert reader pointed out this New York Times article about the dramatic costs imposed by elevator rules. It’s the first I’ve heard of it, but would like to know what others know and think.

BUILDING MORE HOUSING IS NECESSARY BUT NOT SUFFICIENT: THE SOMERVILLE EXAMPLE

Building new units, especially affordable ones, is crucial. But it’s going to take decades and a lot more money to build the housing we need to be built, and for the supply to increase enough for reduced prices to trickle down. So far, while we are doing everything possible in Somerville to increase new housing units, both affordable and market rate, increased production has not stopped unaffordable increases.

Somerville, the most densely populated city in New England, has 20% inclusionary zoning, which means developers building more than 18 units must include 20% low or moderate income units, with lower requirements for fewer units. There is no single-family zoning in Somerville, and Accessory Dwelling Units (ADUs=small extra apartments on lots that already have buildings) can be built “as of right” – without a special permit.

Somerville is building thousands of new units, adding height and density. For example:

- Assembly Row (over 1400 new condos and apartments in buildings of 20 or more stories)

- Union Square (two new buildings, 25 and 6 stories, will have 450 units, 87 of them affordable; one is taller than all but two buildings in Cambridge)

- Boynton Yards (450 apartments in 24-story buildings are going up)

- Clarendon Hill development will add 375 units as well as rebuilding a public housing project.

Gov. Healey recently announced Affordable Housing grants to Somerville Community Corporation to help build

- 115 all-affordable family homes,16 units deeply affordable, replacing the long-closed Star Market

- 60 all-affordable homes, 18 units deeply affordable, in Union Square

- 92 all-affordable homes, including at least a dozen deeply affordable. (part of Phase II Clarendon Hill Reconstruction, which will upgrade 216 public housing units, adding 80 moderate-income units and 295 market-rate units.

Despite this progress, in the past 5 years, average rent increased by 34-58%, or over twice as much as inflation. And from 2021 to 2022, the median sale price went up 44.4%. (p. 105)

MEANWHILE, WE’RE LOSING NATURALLY AFFORDABLE HOMES

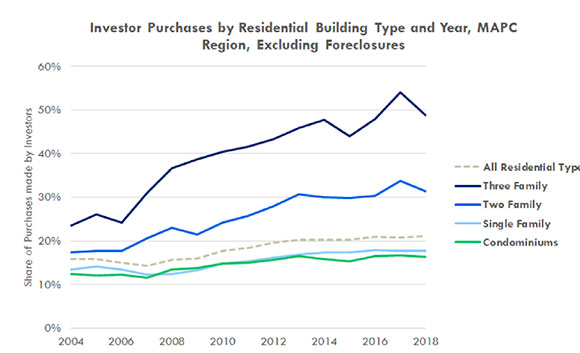

A recent report, Homes for Profit: Speculation and Investment in Greater Boston, shows that investors are purchasing increasing numbers of homes, outbidding potential homebuyers and raising rents. In Greater Boston, half of 3-families and a third of 2-families are sold to investors. (see previous newsletter: Who’s Buying Homes?)

Large investors know that they can raise rents, evicting tenants or pricing them out – to justify their high payments. They can pay cash with no conditions.

We Buy Ugly Houses says they are America’s #1 home buyer.

We aren’t just losing affordable housing. We’re losing home-ownership opportunities for the middle class. Three years ago, Bill White (then Somerville Councilor at Large) told me the percentage of 2-family homes with residential property tax exemptions had dropped from 60% to 56% in the previous 5 years. Homes are eligible for a residential property tax break if the owner lives there. Homes owned by absentee landlords or speculators are not eligible. For 3-family homes residential exemptions have dropped from 41% to 32%; even condos have gone from 58% to 56%.

Bill White concluded that “residential ownership has dropped over the last 5 years…We lost 675 resident-owned multi-families.”

NEXT: WHAT WE NEED RIGHT NOW!

Stay tuned and stay in touch.

Reader Comments